Accrual Accounting vs Cash Basis Accounting: What’s the Difference?

Content

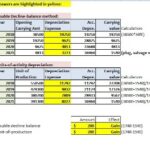

Under the cash basis, the revenue would not be reported in the year the work was done but in the following year when the cash is actually received. Cash basis accounting is a method of recording financial transactions which records transactions only when cash has been exchanged between parties. This contrasts with accrual basis accounting, which records transactions based on economic impact. When thinking about accrual vs cash accounting, remember that accrual keeps record of any sales where cash keeps record of income only.

For example, “Accounting for Compensated Absences” requires employers to accrue a liability for future vacation days for employees. When June’s salaries are paid in July, no expense is recognized at that time. Both a payable and Cash are reduced at that time, but no expense is involved. The decrease in the firm’s net assets and the corresponding expense were recorded in June.

Need help with accounting? Easy peasy.

Throughout the text we will use the accrual basis of accounting, which matches expenses incurred and revenues earned, because most companies use the accrual basis. Comparatively, under the accrual accounting method, the construction firm may realize a portion of revenue and expenses that correspond to the proportion of the work completed. It may present either a gain or loss in each financial period Accrual Basis Of Accounting Definition in which the project is still active. If companies received cash payments for all revenues at the same time those revenues were earned, there wouldn’t be a need for accruals. However, since most companies have some revenues in the year that were earned (i.e., good/services were delivered) but for which payment was not received, the companies need to account for those uncollected revenues.

- One reason for the accrual method’s popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they’re generated.

- The accrued revenue account contains amounts not yet billed to customers, but which have been earned.

- These include white papers, government data, original reporting, and interviews with industry experts.

- Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and record expenses as they are incurred.

- Cash-basis accounting is an accounting approach that recognises revenues and expenses when cash is received or paid out.

If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. To record receipt of soccer ball inventory and establish a debt to Soccer Experts. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. As a result, an investor might conclude the company is making a profit when, in reality, the company might be facing financial difficulties. It’s beneficial to sole proprietorships and small businesses because, most likely, it won’t require added staff to use.

Choosing the Right Accounting Method

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. After submitting your application, you should receive an email confirmation from HBS Online. If you do not receive this email, please check your junk email folders and double-check your account to make sure the application was successfully submitted. Our easy online application is free, and no special documentation is required. All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. The applications vary slightly from program to program, but all ask for some personal background information.

- After submitting your application, you should receive an email confirmation from HBS Online.

- A lender, for example, might not consider the company creditworthy because of its expenses and lack of revenue.

- All companies that report financial statements according to GAAP rules use accrual accounting.

- According to GAAP, and in accordance with the revenue recognition principle and the matching principle, you must prepare all financial statements using accrual accounting.

A Cash Flow Statement is a financial statement that tracks the movement of a company’s cash over a selected period of time. This is an all-inclusive statement because it includes the inflow and outflow… Explore our eight-week online course Financial Accounting and other finance and accounting courses to discover how managers, analysts, and entrepreneurs leverage accounting to drive strategic decision-making. https://kelleysbookkeeping.com/ Accrued revenue occurs when a company has delivered a good or provided a service but hasn’t yet received payment. These accounts are often seen in the cases of long-term projects, milestones, and loans. For income tax or sales tax due on revenue, the company recognizes the tax during the same period it recognizes the revenue, even though it pays the tax when required by the IRS.

How Do You Explain Accrual to Non-Accountants?

Expenditures are recognized when the obligations are created, except for amounts payable from future fiscal year appropriations. Even startups that start out using the cash method due to its simplicity, tend to eventually move to accrual basis accounting when it comes time to apply for outside funding. So even if you don’t follow this standard now, you will likely have to in the future. Accrual accounting must be used for any regulatory filing that requires GAAP, such as a company’s annual 10-K filing to the SEC.

- The cash basis method typically is used by sole proprietors and smaller businesses.

- Although it’s the more complex of the two major accounting methods, accrual accounting is considered the standard accounting practice for most organizations.

- In contrast, accrual accounting does not directly consider when cash is received or paid.

- Accrual basis accounting means the recognition of transactions and events when they occur.

- For example, let’s say that a clothing retailer rents out a storefront for $2,500 per month, paying each month’s rent on the first day of the following month.

- Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends.

The accrual method is the more commonly used method by large companies, especially by publicly-traded companies, as it smooths out earnings over time. Prepare Financial StatementsBefore we can prepare adjusting journal entries, we need to understand a little more theory. Learn about data entry, bank rec, reporting and tax prep in our guide to doing bookkeeping. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For example, if a firm prepays its rent for the month of June in May, the prepayment is considered an asset in May and is not considered an expense until June.

How to create your own bookkeeping system for arts businesses

The accrual based accounting definition, or accrual basis accounting, forms a method of recording financial transactions based on economic impact. Then, record costs when incurred, whether or not cash has actually been exchanged between the relevant parties. Contrast this method with cash basis accounting, which records transactions only when cash has been exchanged between the relevant parties. The accounting world uses the accruals concept well, in the accounting world it is far more common to use accrual accounting rather than cash accounting. Accrual basis accounting is the standard approach to recording transactions for all larger businesses.